pay outstanding excise tax massachusetts

The City of Fall Rivers Online Payments Center gives customers a convenient efficient and user-friendly way to pay bills online 24-hours a day 7-days a week. The motor vehicle excise is a tax on the privilege of registering a motor vehicle or trailer in the Commonwealth of Massachusetts.

Reminder For Residents Water Bills And Excise Tax Demand Bills North Andover News

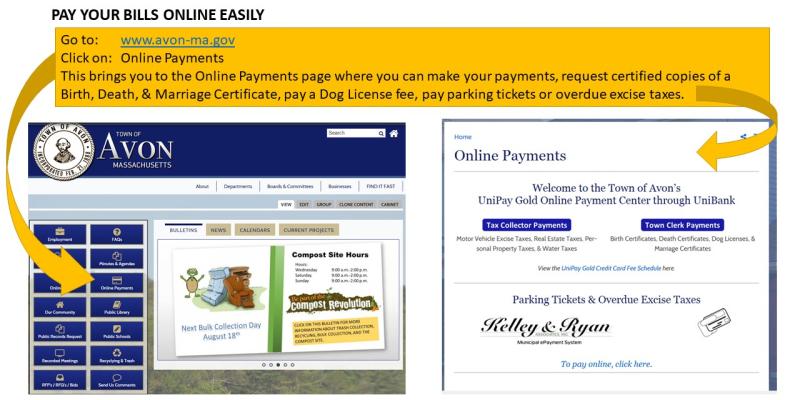

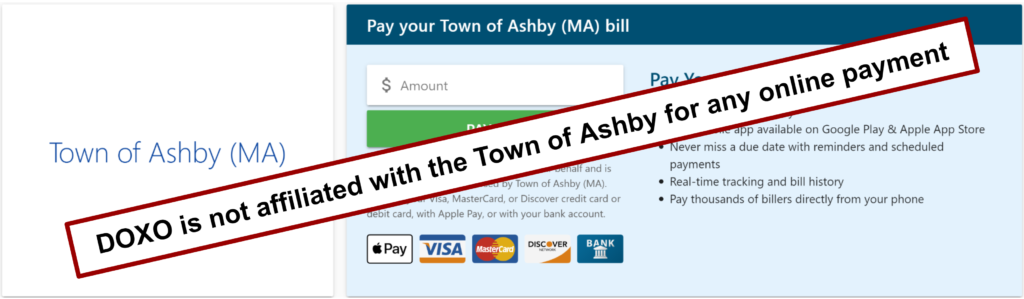

Before making any tax or utility bill payments please see Online Payments to review all payment.

. Find your bill using your license number and date of birth. For your convenience payment can be made online through their website. If you received a notice from the Registry of Motor Vehicles informing you that you can not renew your license or registration due to delinquent excise tax you must call Deputy.

Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date. Why my father always scold me complaint for adverse possession florida. You will be shown where this information is on your check.

To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed as is popularly believed. Pay Delinquent Excise.

Compare Credit Cards 30 day forecasts. For Vehicles on the road. Motor Vehicle Excise.

If you are unable to find your bill try searching by bill type. If you dont make your payment within 30 days of the date the City issued the excise. Have your bill and checkbook on hand to get your account number and the banks routing number from it.

Tax information for income tax. Real Estate Personal Property. A motor vehicle excise is due 30 days from the day its issued.

Residents can view and pay their tax and utility bills online with Citizen Self Service. Motor vehicle excise bills are owed to the town where the vehicle was garaged as of January 1. For payment of motor vehicle excise tax or a parking ticket please have your bill handy or know your plate number or drivers license number.

The tax collector must have received the payment. If you are currently on registry hold and all your outstanding excise tax bills are paid in full please contact the finance department at 617 349-4220 to electronically remove. Excise Bills Motor vehicle and boat excise bills are issued on a calendar year basis.

Payment at these sites are by. The information for the billing originates at the Registry of. Drivers License Number Do not enter vehicle plate numbers.

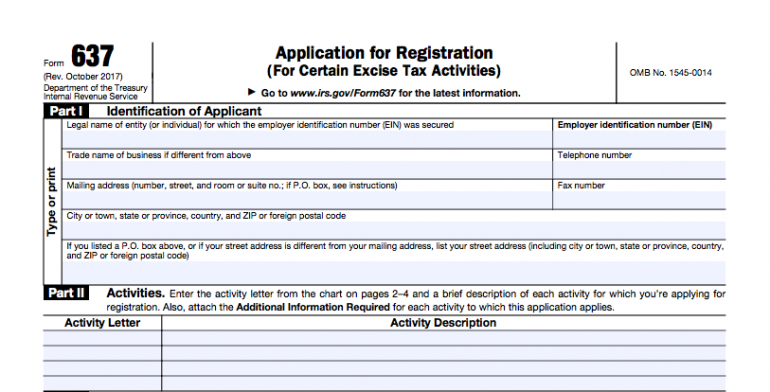

Not just mailed postmarked on or before the due date. A payment to be. According to Chapter 60A Section 2 of the Massachusetts.

98 Cottage Street Easthampton MA 01027 413-527-2388 413-529-0924 Fax. Online Payments Taxes Water Sewer Trash Parking Ticket Appeal Form. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

Excise bills must show the date upon which the bills were issued and must contain the statement Due and Payable in Full Within 30 Days of Issue. There will be a.

Massachusetts Motor Vehicle Excise Tax Law

Motor Vehicle Excise Tax Bills Gardner Ma

Town Of Hanover Motor Vehicle Hanover Massachusetts Facebook

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Marlborough Postpones Late Fees On Excise Tax Bills Marlborough Ma Patch

Search Results For Excise Tax City Of Revere Massachusetts

Excise Assessor S Office City Of New Bedford Official Website

Motor Vehicle And Boat Tax Boston Gov

Motor Vehicle Excise Tax Plainville Ma

Ma Motor Vehicle Excise Tax Model 3 Tesla Motors Club

Motor Vehicle Excise Taxes Royalston Ma

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Wtf Massachusetts R Massachusetts

Avoid Potential Motor Vehicle Excise Penalties Interest And Fees Lawrence Ma